Teck Resources Ltd. - A Top Pick in Copper

The future is electric, and copper is the backbone of this revolution.

Teck is a major diversified resource company with a growing copper production profile. Their Highland Valley Copper mine in British Columbia is a cornerstone, and their Quebrada Blanca Phase 2 (QB2) project in Chile is a world-class, low-cost copper mine that has recently commenced production and is expected to significantly boost their copper output.

Catalysts for higher copper prices:

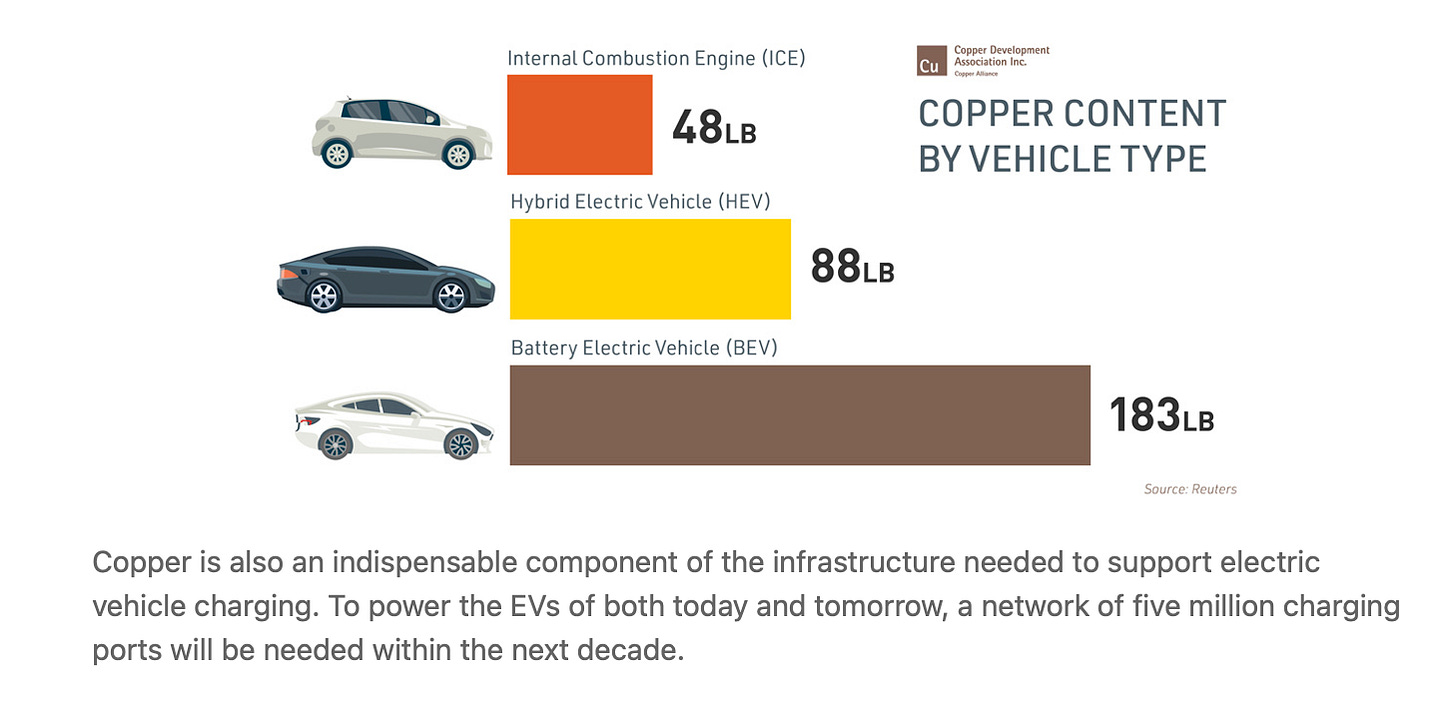

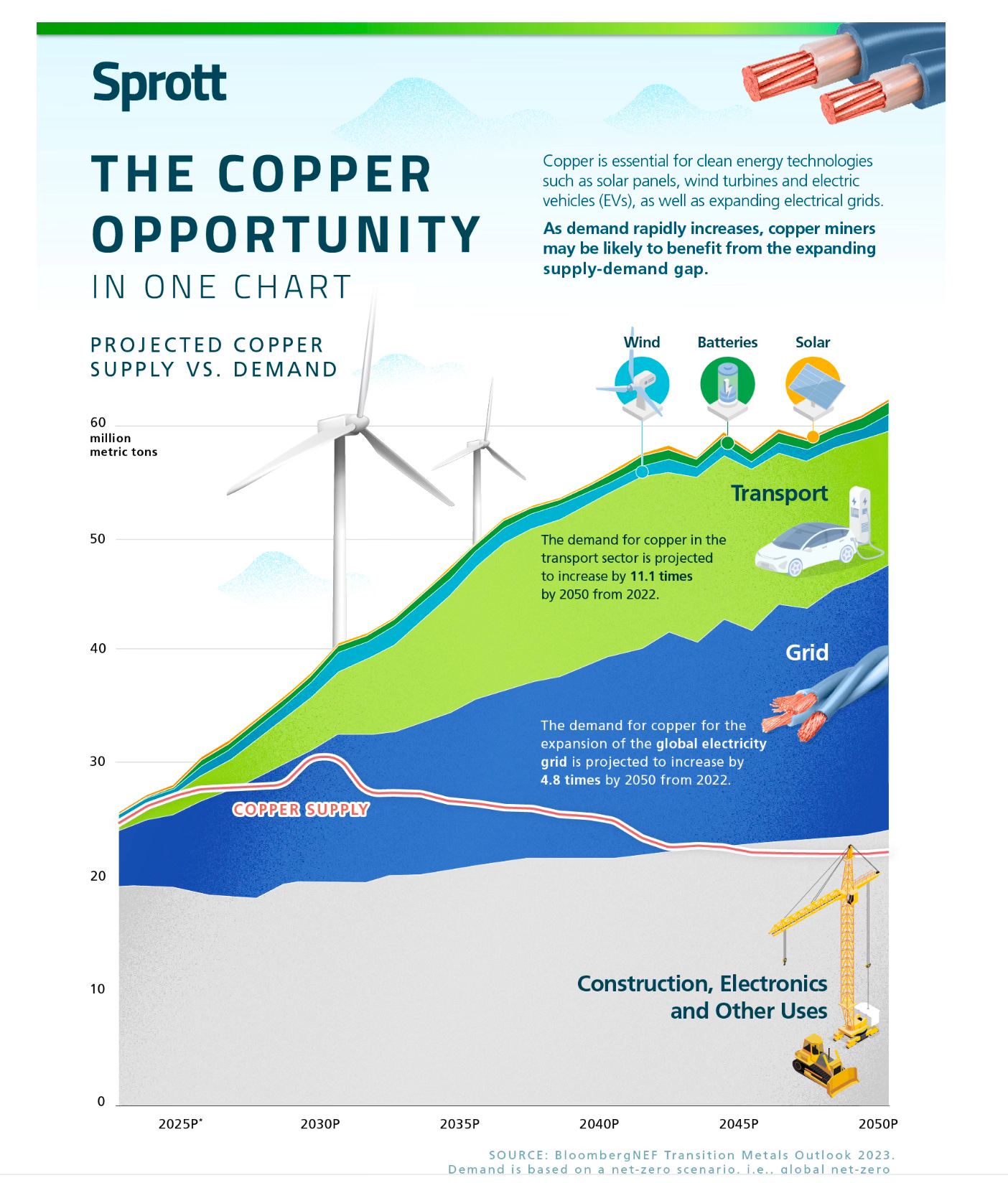

Energy Transition: Electric vehicles (EVs) require significantly more copper than internal combustion engine vehicles. Renewable energy infrastructure, like solar and wind farms, are also heavily copper-intensive for wiring and grid connections.

https://copper.org/environment/sustainable-energy/electric-vehicles/

Decarbonization Goals: Governments and industries worldwide are setting ambitious decarbonization targets, fueling investment in electrification and clean energy technologies that rely on copper.

Infrastructure Development: Growing populations and urbanization, particularly in developing economies, necessitate substantial investments in infrastructure, including power grids, transportation, and construction – all major consumers of copper.

Supply Constraints: While demand is surging, new large-scale, high-grade copper discoveries are becoming increasingly rare, and bringing new mines online is a lengthy and capital-intensive process. This supply-demand imbalance is expected to support higher copper prices in the long term.

Why choose Teck Resources to participate in this copper bull market?

It's a member of the TSX 60 - Which is a distinguished list. The TSX 60 are the largest publicly traded Canadian companies by market capitalization listed on the Toronto Stock Exchange.

It's dual listed in both Canada TECK.B on the Toronto Stock Exchange and TECK on the NYSE.

Significant Copper Production & Growth: Teck is a major diversified resource company with a growing copper production profile. Their Highland Valley Copper mine in British Columbia is a cornerstone, and their Quebrada Blanca Phase 2 (QB2) project in Chile is a world-class, low-cost copper mine that has recently commenced production and is expected to significantly boost their copper output.

Low-Cost Production Potential: QB2 is projected to be a low-cost operation, enhancing Teck's profitability and resilience to price fluctuations. This positions them favorably compared to higher-cost producers.

Diversified Portfolio Provides Stability: While copper is a key focus, Teck also produces steelmaking coal and zinc. This diversification can provide a buffer against commodity-specific volatility and offers exposure to other attractive markets.

Strong Financial Position: Teck has been focused on strengthening its balance sheet, which provides financial flexibility for future growth projects and potential shareholder returns.

Commitment to Sustainability: Teck is increasingly focused on sustainable mining practices and responsible resource development, aligning with the growing importance of ESG (Environmental, Social, and Governance) factors for investors.

Quebrada Blanca Phase 2 (QB2) - A Game Changer

Let's take a closer look at QB2:

World-Class Asset: This is a large-scale, long-life copper mine with significant expansion potential.

Low-Cost Production: Expected to be in the lower quartile of the global cost curve.

Significant Production Increase: QB2 is projected to more than double Teck's consolidated copper production.

Long-Term Value Driver: This project positions Teck as a major copper producer for decades to come.

The Chart

Here is the 5 Year, Monthly Chart. Teck is sitting at an area of support (purple line). Look for lift in this area in the months to come.

Final Thoughts

In conclusion, the fundamental outlook for copper is exceptionally strong, driven by the global energy transition and infrastructure demands. Teck Resources, with its existing significant copper production, the transformative QB2 project, and a commitment to sustainability, offers investors a compelling opportunity to participate in this exciting market. While all investments carry risk, Teck's strategic positioning makes it a noteworthy consideration for those bullish on copper's future.

Disclaimer:

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice. The opinions expressed are those of the author and are subject to change without notice. Always do your own research and consult with a qualified financial advisor before making any investment decisions. The author may hold positions in the securities mentioned

If you’re ready to learn how to spot opportunities like this on your own, you’re in the right place. The Positive Point is here to teach you the art and science of reading a stock chart—so you can invest with clarity and confidence. Email me at sue@thepositivepoint.com to get started.

Let’s chart the course—together!

Teck Resources Ltd. is one of the biggie copper producers and well-positioned for future demand, but it may not be the best 'investment prospect' from both fundamental & technical perspectives. Teck is a higher-priced producer with a relatively safe dividend, but it is currently over-valued ($49.43 vs. $44.03) with declining sales, earnings, margins, as well as negative growth prospects for the coming year. However, there is another up & coming copper producer, Imperial Metals Corporation (III), that could offer a better investment return. Imperial Metals is currently under-valued ($3.82 vs. $5.26) with one of the better price, sales, and earnings performances, as well as future growth prospects. Bigger is not always better, and Imperial looks like royalty on the fundamental & technical charts, so probably better from an investment perspective. Take care and enjoy the journey!